When I first got into crypto, I used to chase hype. I’d see Twitter buzzing about a coin, or TikTok shouting that “altcoins are the next Bitcoin,” and I’d throw money in. Most times, I was late. By the time I arrived, the smart money had already taken profits, and I was left holding the bag.

That’s when I realized: the real winners don’t just follow hype, they follow data.

Numbers don’t lie. Charts don’t get emotional. If you want to catch the next big altcoin before the crowd does, you need to pay attention to market metrics. They’re like road signs that point to where liquidity, adoption, and community energy are flowing.

In this post, I’ll show you exactly how I use market data to spot potential gems, step by step.

Why Market Data Is Everything

There are thousands of altcoins out there. Some will explode, some will fade into obscurity. The difference between guessing and winning often comes down to one thing: data-driven decisions.

When I look at metrics, I’m not guessing. I’m watching actual signals, things like volume spikes, TVL growth, on-chain activity, and even social buzz. Together, these paint a picture of where money and people are moving.

Think of it like fishing: hype is the rumor that “fish are biting over there.” But market data? That’s the sonar showing you where the fish actually are.

Trading Volume Spikes

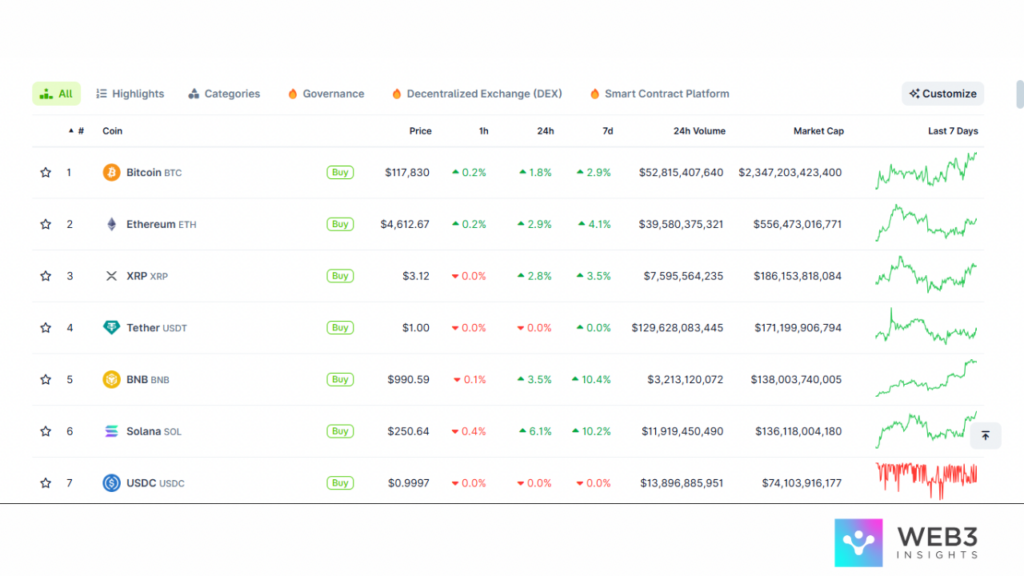

The first thing I always check is trading volume.

Here’s why: before a price explosion, there’s usually an increase in trading activity. More buyers and sellers crowd into a coin, which shows demand building up. Sometimes the price doesn’t move yet, but the surge in volume tells me that something is brewing.

For example, I remember watching Solana back when its daily volume suddenly doubled, even though the price hadn’t pumped yet. Within weeks, it went on a massive rally.

Where I check:

- CoinGecko “Top Volume Gainers”

- CoinMarketCap 24h volume charts

If you spot an altcoin with a sudden spike in trading activity, keep it on your radar.

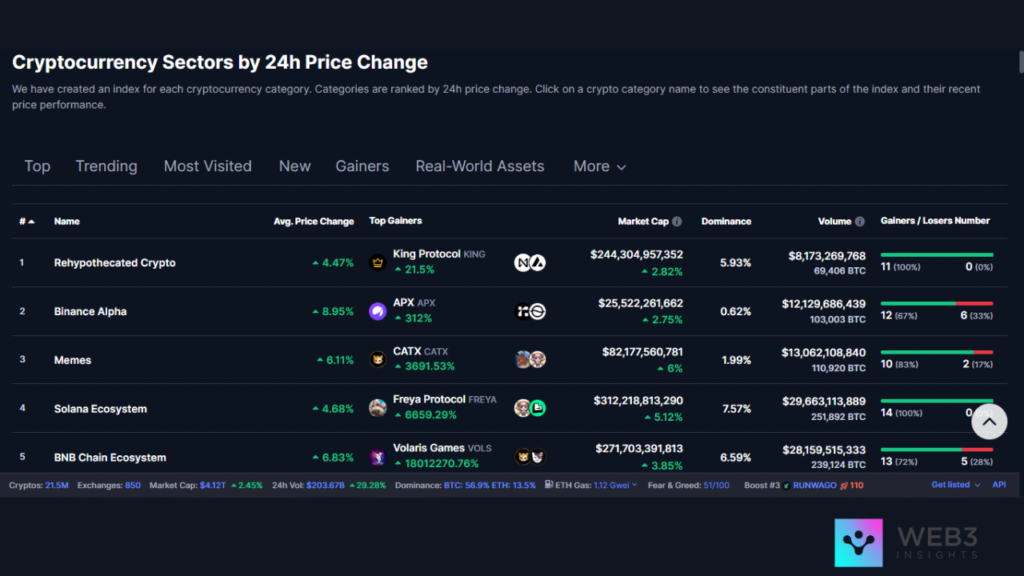

TVL Growth in DeFi

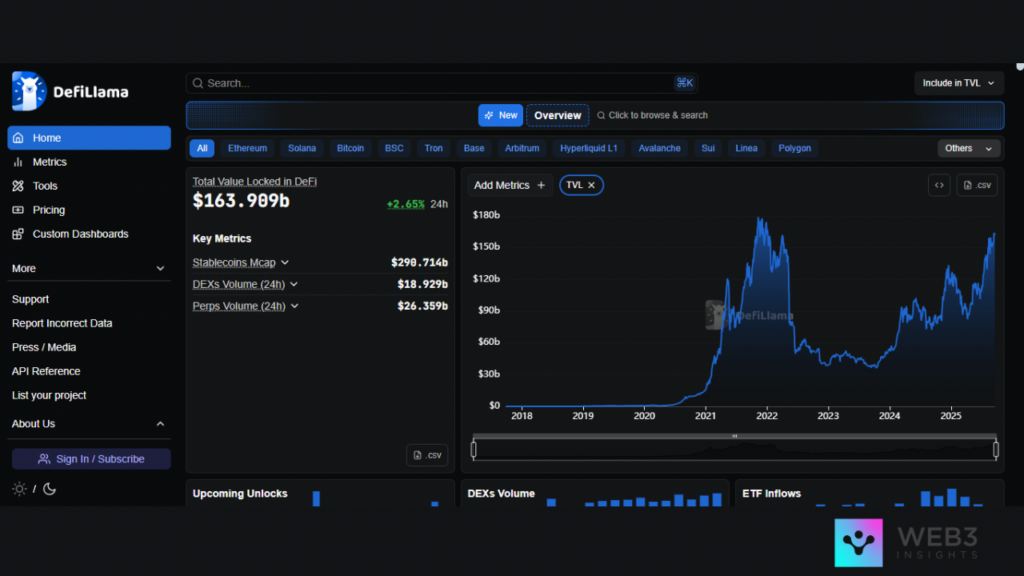

Next up is Total Value Locked (TVL).

TVL tells me how much money people are actually putting into a blockchain or DeFi protocol. And let me tell you, people don’t lock up millions for no reason. If the TVL of a coin is growing consistently, it’s usually a sign that confidence is building in that ecosystem.

Take Ethereum, for instance. It has the highest TVL because DeFi literally lives on Ethereum. But the more interesting plays are in chains like Solana, Avalanche, or even newer entrants where TVL is growing fast.

That growth often comes before a token price boom.

Where I check:

- DefiLlama chain overview

- Project-specific dashboards

Altcoins On-Chain Activity

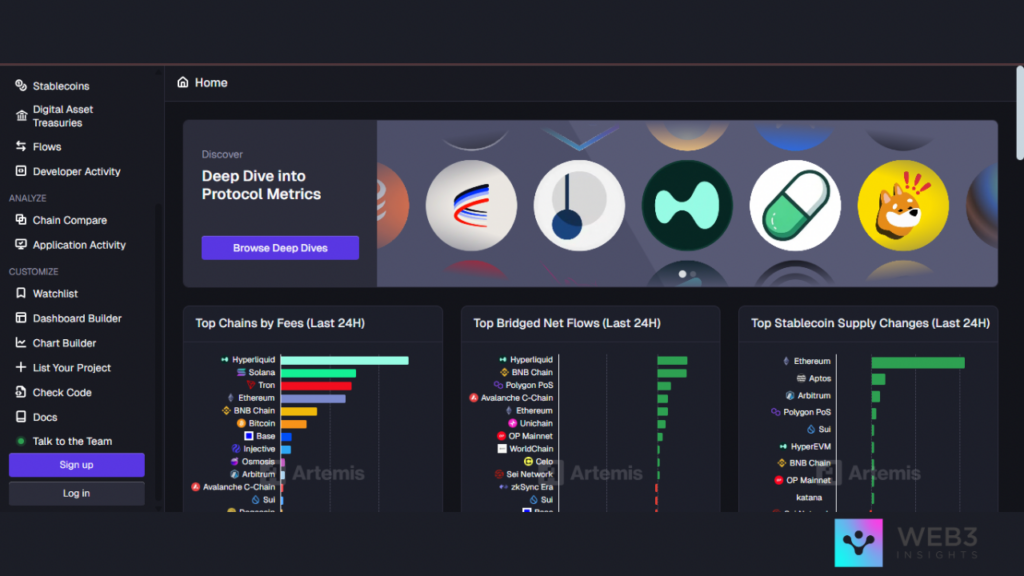

This is where I get a little more nerdy, but it’s worth it.

On-chain data tells me what’s happening behind the scenes: how many wallets are active, how many transactions are going through, and whether new users are joining.

The beauty of blockchain is that everything is transparent. If I see a sudden jump in active addresses for an altcoin, it usually means adoption is growing, even if the price hasn’t reflected it yet.

I once watched Polygon’s daily active addresses chart rise steadily for weeks. Later, when partnerships were announced, the price finally caught up.

Where I check:

- Artemis (wallets & transactions)

- Santiment (active addresses)

- Glassnode (for deeper Bitcoin/ETH metrics)

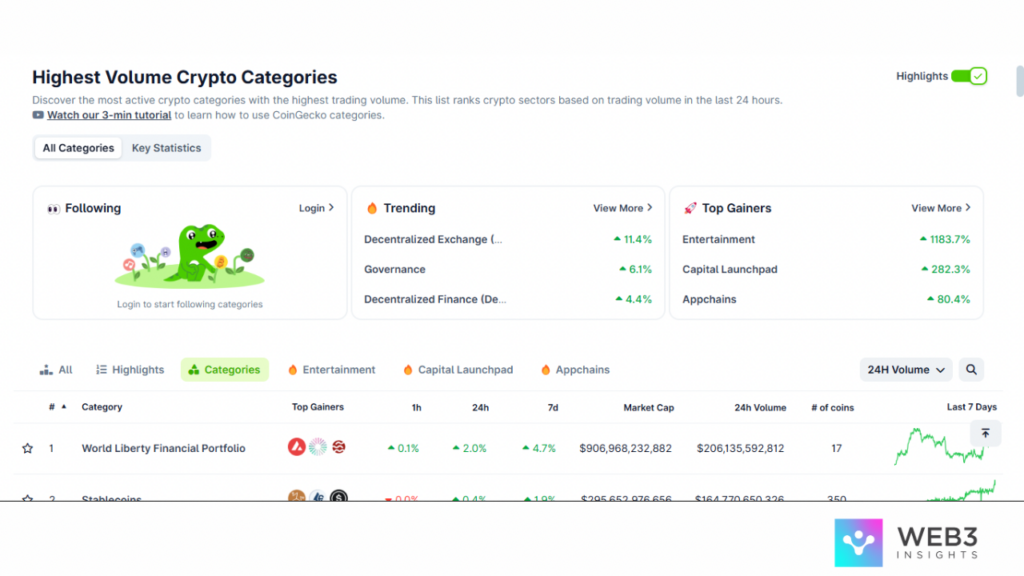

Social Buzz and Community Growth

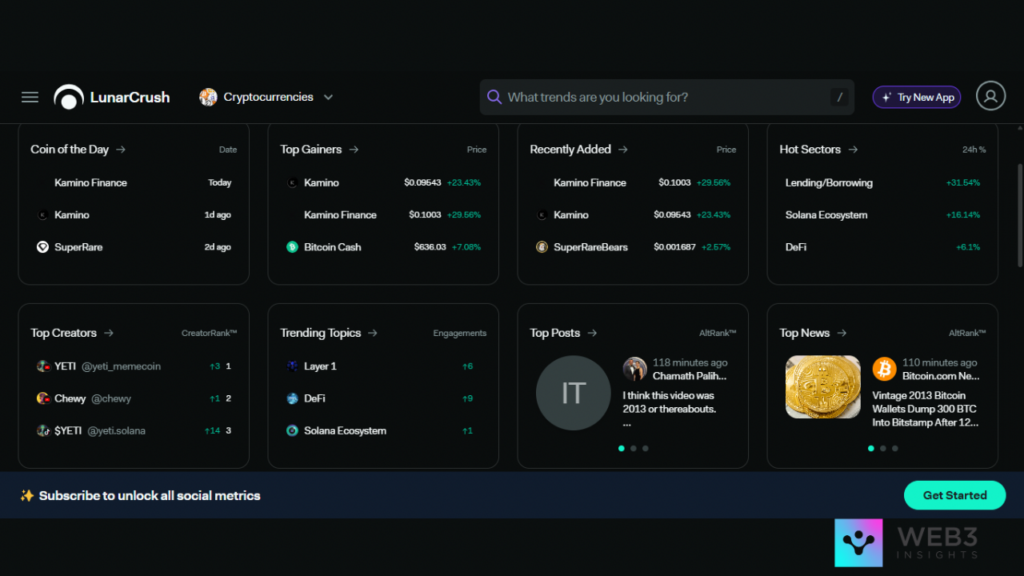

Now let’s be honest, crypto lives on social media.

No matter how strong the fundamentals, altcoins without community hype rarely moves. This is why I pay attention to social metrics. If a coin is suddenly trending on Twitter or racking up engagement on platforms like LunarCrush, I know attention is coming its way.

Remember Dogecoin? Its biggest rallies didn’t start with fundamentals. They started with Elon tweets and viral memes.

So I combine social sentiment with the other data. If the numbers look good and the community is buzzing, that’s when I lean in.

Where I check:

- LunarCrush dashboard

- Twitter/X trending page (crypto hashtags, mentions)

Final Thoughts

Spotting the next big altcoin isn’t about luck. It’s about putting the right signals together before the rest of the market catches on.

I don’t always get it right, no one does. But following the data has saved me from chasing hype and helped me catch some pretty sweet runs.

So the next time you’re tempted to ape into a random token because of TikTok or Telegram shills, pause. Open up CoinGecko, DefiLlama, Artemis, and LunarCrush. Let the data tell the story.

Because in crypto, those who pay attention to the numbers usually end up ahead of the noise.