It’s official: the U.S. Senate just gave stablecoins a major thumbs-up on 19th of May. After months of heated debate and political tug-of-war, the stablecoin bill (formally known as the GENIUS Act) is finally moving forward.

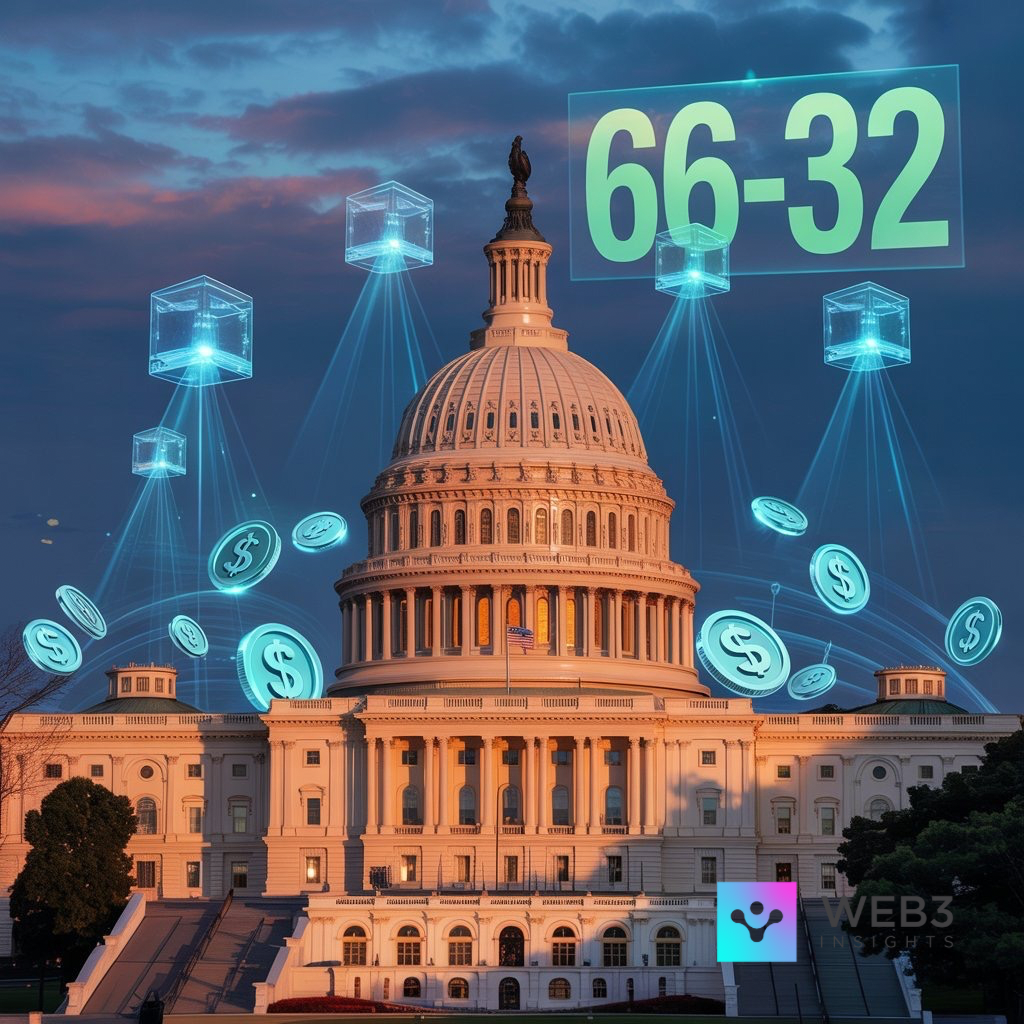

The vote? 66 senators in favor, 32 against, and two sat it out. That’s a big shift from earlier this month, when the same bill couldn’t even get through a procedural vote.

If you read our last article, you know this bill has been in limbo for a while. The earlier version stumbled over concerns about Big Tech, privacy, and whether stablecoins were ready for the spotlight. But something changed. Sixteen Democrats decided this time to back it. Now, stablecoins aren’t just crypto’s best-kept secret, they’re front-page policy.

Let’s break down what this bill actually does, what just happened in Congress, and what this moment could mean for crypto’s future.

What the Stablecoins Bill Actually Does

Let’s keep this simple: the GENIUS Act is all about giving stablecoins structure. It says, “If you’re going to issue digital dollars, here are the rules.”

First up, “federal oversight”. No more issuing coins in the wild west. If you want to run a stablecoin project in the U.S., you need a license and you’ll be regulated like a real financial institution.

Then there’s the money itself. Every stablecoin has to be backed 1:1 by real, safe assets like U.S. dollars, treasuries, and other liquid reserves. You’ll also need “third-party audits” to prove you’re not just printing funny money.

And to make sure these digital dollars don’t cause chaos, the bill creates a new watchdog: the “Stablecoin Certification Review Committee. Their job? Review coins, look for red flags, and keep the system in check.

Now, about Big Tech. Companies like Meta and Amazon can’t just wake up and launch their own coins. They’ll need approval, which slows things down but also adds accountability.

Finally, the bill tackles something we all care about: PRIVACY. Your stablecoin data can’t just be scooped up and sold to advertisers. There are clear protections that make sure you’re not the product.

All in all, it’s a grown-up set of rules for a part of crypto that’s been growing up fast.

Stablecoins Just Got Senate Approval: So, What Now?

This vote doesn’t mean the bill is law yet, but it’s a huge deal. What just happened was a cloture vote; basically a way to end the back-and-forth and move things closer to a final decision. It’s the first time the U.S. government has said, loud and clear, that stablecoins deserve a real legal framework.

The bill had failed earlier this month because lawmakers were still arguing over Big Tech involvement and how user data would be handled. This time, thanks to bipartisan effort and a growing sense that the U.S. needs to lead on digital finance, the bill got the green light to move forward.

Senators like Kirsten Gillibrand, Alsobrooks, and Gallego helped rally support on the Democratic side. It was enough to push the GENIUS Act over the line.

Stablecoins are no longer just background tools for crypto traders. They’re about to go mainstream and fast.

Not Everyone’s Sold on It

Even with the momentum, not everyone’s clapping.

Senator Elizabeth Warren came out, saying not enough has changed since the bill’s earlier draft. She called it a weak compromise and warned it could do more harm than good.

Senator Mark Warner raised a different red flag. He pointed to the TRUMP memecoin and the USD1 stablecoin, both of which have ties to Trump allies and foreign investors. Warner’s concern: crypto being used to dodge oversight and push shady deals.

Still, Warner admitted something important: crypto isn’t going anywhere. He said, “Innovation in this space is happening, with or without us.” That’s a rare moment of clarity in Washington.

The bottom line? Not everyone is on board. And with more debate still ahead, expect some last-minute edits, especially around who gets to issue stablecoins and how those operations are monitored.

What This Means for the Future of Stablecoins and Crypto

Alright, now let’s talk about why this actually matters beyond D.C.

Stablecoins power most of the crypto economy. They’re the glue between blockchains, banks, and users. Until now, they’ve been operating in a legal gray area, too big to ignore, too unregulated to fully trust.

This bill changes that;

1. Trust Goes Up: With federal rules in place, people will feel more confident using stablecoins in everyday transactions.

2. Institutions Dive In: Big players like Visa, Mastercard, and PayPal are already exploring stablecoins. Now they have a framework to go all in.

3. Global Playbook: The U.S. is setting a standard that other countries might follow. This isn’t just about domestic policy; it’s about global influence.

4. DeFi Matures: Decentralized finance depends on reliable, liquid assets. Clear regulation boosts confidence and invites new types of users.

5. Business Adoption: Small and medium-sized businesses could embrace stablecoins for faster, cheaper settlement options that bypass traditional banking rails.

The best part? Stablecoins can finally start doing more than just sitting in wallets. With rules in place, they can power payroll, remittances, ecommerce, and even government payments.

Final Thoughts

This isn’t just a bill. It’s the start of a new chapter for crypto in the U.S.

Stablecoins aren’t experimental anymore. They’re becoming infrastructure, just like checking accounts, credit cards, and cash apps.

There’s still work to do before the bill becomes law. But for the first time, Washington isn’t just reacting to crypto, it’s shaping it.

And if this momentum holds, we might be looking at the moment stablecoins stopped being the side story and became the main one.