Every year, millions of people make predictions. Who will win the next big election? Others debate whether interest rates will rise or fall. Imagine a place where all those beliefs could be traded, measured, and turned into real, actionable information. That is exactly what prediction markets are, and they could transform how we understand uncertainty, forecasting, and even financial markets themselves.

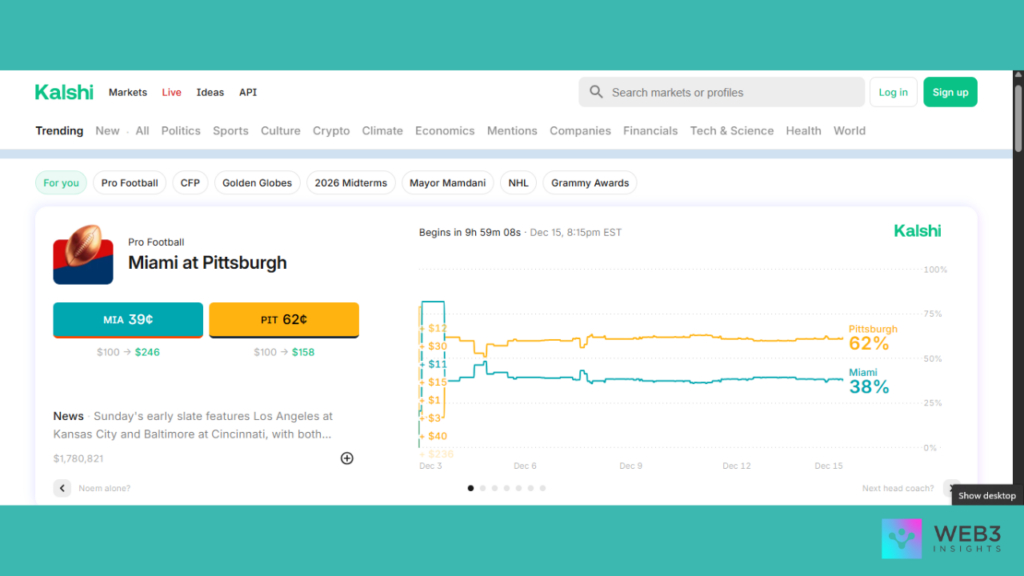

In simple terms, prediction markets are marketplaces for future events. Instead of trading shares in companies, participants trade contracts tied to real outcomes; such as whether a sports team will win or whether a federal interest rate will change by a certain date. The price of each contract reflects the crowd’s belief about the probability of that outcome. If a contract is priced at 70%, the market collectively believes there is a 70% chance it will happen.

Although the concept has existed for decades, it is only in recent years, particularly with the rise of blockchain and crypto that prediction markets have attracted mainstream attention. They are now being watched closely by major financial players, regulators, and even traditional media companies.

How Prediction Markets Work

Think of a prediction market as a stock exchange for the future. Here’s a simple example of how a market functions:

- An event is defined. For instance, “Will the US Federal Reserve hold interest rates steady in June 2026?”

- Contracts are created representing possible outcomes, such as “Yes” or “No.”

- Traders buy and sell these contracts, with the price fluctuating based on supply and demand.

- Once the event occurs, the winning side pays out a fixed amount, while losing contracts expire worthless.

What makes prediction markets particularly powerful is their ability to aggregate diverse information. Instead of relying on a single expert or slow-updating polls, they incorporate real money and real opinions from many participants. The result is a fast-moving, real-time probability indicator, often more accurate than traditional forecasts.

Why Prediction Markets Matter Today

Prediction markets are more than gambling; they are a reflection of collective intelligence. Aggregated beliefs can outperform individual experts or static polls, a phenomenon economists call the “wisdom of the crowd.” Markets formalize this effect in a financial way, providing a continuous, measurable probability of outcomes.

The growth of these markets can be attributed to several factors. Prices update instantly as new information arrives, creating real-time signals. Markets apply to a wide variety of events, including politics, economics, technology launches, sports, and financial metrics.

Blockchain integration allows decentralized participation, enabling global access and reducing censorship. Meanwhile, institutional interest is growing, with exchanges and financial firms investing in prediction market platforms. This combination of technology, participation, and relevance has transformed prediction markets from niche experiments into serious financial and informational tools.

Real-World Examples You Can Explore

There are several platforms worth exploring for live examples, screenshots, or charts:

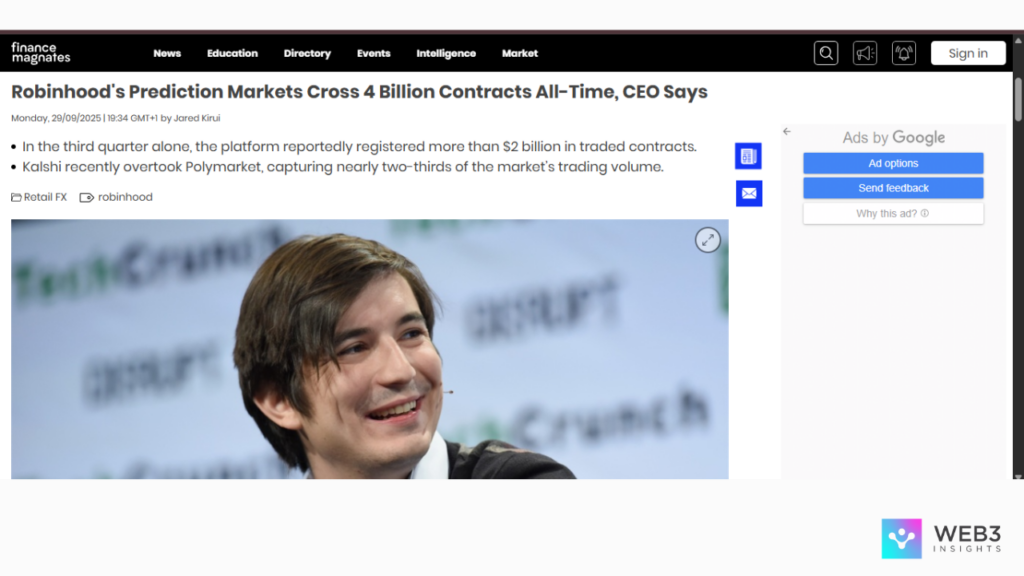

Polymarket is a major crypto-based prediction platform that allows users worldwide to trade on diverse events.

Manifold Markets focuses on reputation-based community forecasting.

Kalshi offers a regulated exchange in the U.S., presenting event contracts resembling financial derivatives.

Metaculus aggregates expert and crowd forecasts on science, technology, and policy outcomes.

These platforms offer visual tools and live data, making them suitable for reports and presentations.

Forward-Looking Perspectives: Analysts and Industry Views

When it comes to the future of prediction markets, there’s more than one credible voice weighing in, and these aren’t guesses; they’re grounded in real developments.

Robinhood’s leadership has publicly highlighted rapid expansion in this area. According to Robinhood’s CEO, prediction markets have been one of the fastest-growing products, with the platform reporting billions of contracts traded across its event markets.

This growth suggests that prediction market activity isn’t just fringe, it’s scaling meaningfully alongside mainstream investing activity, attracting both retail traders and institutional observers.

Institutional interest is also climbing; Intercontinental Exchange (ICE), the owner of the New York Stock Exchange, committed up to $2 billion in Polymarket, a major prediction market platform. That level of capital commitment from a cornerstone of traditional finance sends a strong signal: big financial infrastructure players see prediction markets as more than a niche experiment.

Regulatory and industry strategy are shifting too; A national Coalition for Prediction Markets has recently formed with participation from Robinhood, Coinbase, Kalshi, Crypto.com, and others. The coalition advocates for consistent federal regulation, rather than a fragmented patchwork of state laws. Analysts suggest that clearer regulation will accelerate adoption and provide legal certainty for investors.

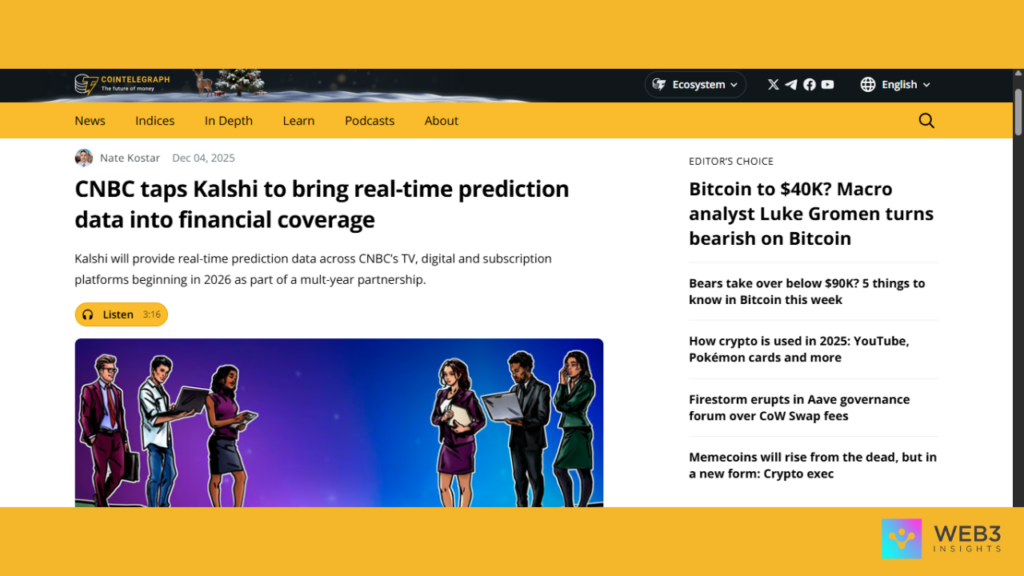

Mainstream media outlets and financial news services are beginning to integrate prediction data as part of their content. CNBC and other platforms are embedding real-time prediction market data into programming, including dedicated tickers that show probability information during live segments. This kind of integration moves prediction markets closer to being standard informational tools on par with market data feeds.

Prediction markets are even gaining legitimacy in traditional sports arenas. The National Hockey League (NHL) signed multiyear agreements with both Kalshi and Polymarket, making them official prediction market partners. This milestone expands public exposure and positions these platforms as legitimate engagement layers, not fringe betting alternatives.

These real developments support a broad consensus among analysts: prediction markets are not static curiosities. They’re gaining real traction across institutional finance, public media, regulatory advocacy, and mainstream cultural platforms.

Looking Ahead: What the Future Could Hold

Prediction markets are poised to become much more than niche tools. Analysts anticipate several possible trajectories:

- Information Infrastructure: Prediction markets may evolve into real-time data sources for investors, policymakers, and analysts, offering faster insights than traditional reports or polls.

- Integration with AI and Analytics: As markets generate larger datasets, AI-driven systems could leverage prediction market signals to improve forecasting models across economics, finance, and policy.

- New Financial Tools: Markets may integrate with hedge strategies, risk-adjusted portfolios, or macroeconomic dashboards, providing actionable probabilities for professional decision-making.

- Cultural Adoption: With media platforms and financial services displaying real-time probabilities, the public may start treating these numbers as standard metrics, much like stock tickers or weather forecasts.

If these developments occur, prediction markets could transition from niche curiosity to a foundational element of how society measures and responds to uncertainty.

Conclusion

Prediction markets are deceptively simple but remarkably powerful. They turn collective belief into measurable probability and provide insights that can inform trading, investment, policy, and public understanding. Platforms like Polymarket, Kalshi, Manifold Markets, and Metaculus illustrate how blockchain innovation, institutional investment, and mainstream adoption are converging to unlock this potential.

For investors, traders, and policymakers, prediction markets offer a new lens through which to view uncertainty. As technology improves, adoption grows, and regulation becomes clearer, these markets may not just track the future, they could help shape it.