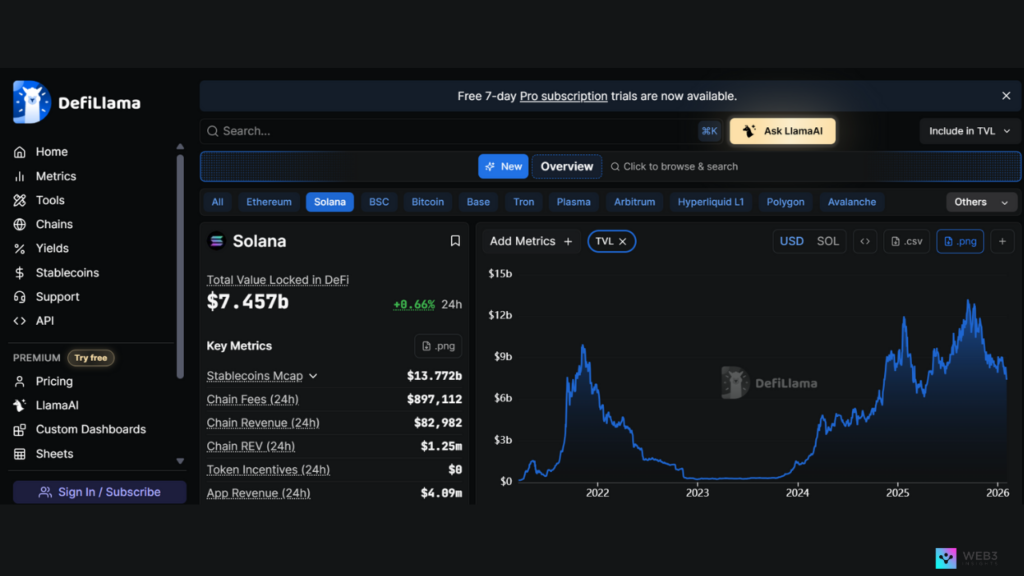

The Solana ecosystem is evolving at breakneck speed, and 2026 is set to be a defining year for some of its most innovative protocols. While hundreds of projects are building on Solana, only a few will emerge as dominant forces in DeFi, NFTs, and on-chain infrastructure. Using research, we’ve identified three standout protocols poised to lead the pack.

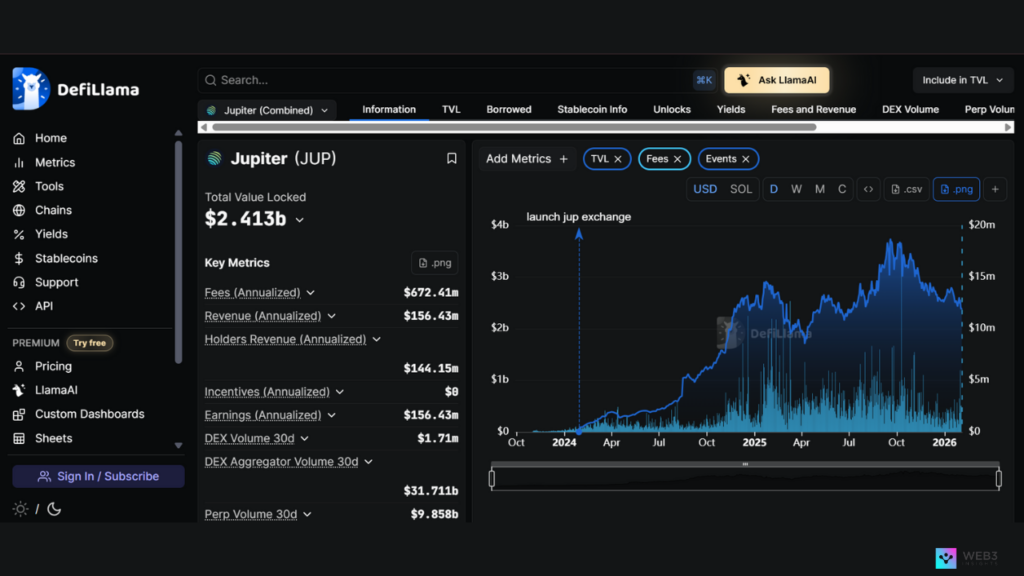

1. Jupiter (JUP): The Liquidity King of Solana

Jupiter is the go-to liquidity aggregator on Solana, ensuring users get the best rates across decentralized exchanges (DEXs). In any blockchain ecosystem, liquidity is the backbone of a healthy market, and Jupiter has positioned itself as the primary gateway for seamless token swaps. Unlike single-DEX platforms, Jupiter scans multiple liquidity sources to find the most efficient trade routes with minimal slippage.

Key Stats:

- Processes millions of trades daily, optimizing for the best swap routes.

- Aggregates liquidity from major Solana DEXs, ensuring minimal slippage.

- Recently launched limit orders and dollar-cost averaging (DCA) features to enhance user experience.

- Integrated with over 30 protocols, solidifying its dominance in the Solana DeFi space.

How It Works:

Jupiter uses smart routing technology to analyze liquidity pools across multiple Solana DEXs, ensuring that users always receive the most favorable rates. Its automated order execution helps traders avoid front-running and unnecessary slippage, making it an indispensable tool for casual and professional traders.

Why It Will Dominate:

As Solana’s DeFi ecosystem grows, having a reliable, high-performance aggregator like Jupiter will be essential for both retail and institutional traders. With increased demand for decentralized trading, Jupiter’s deep liquidity access and efficiency give it a competitive edge over fragmented, isolated exchanges.

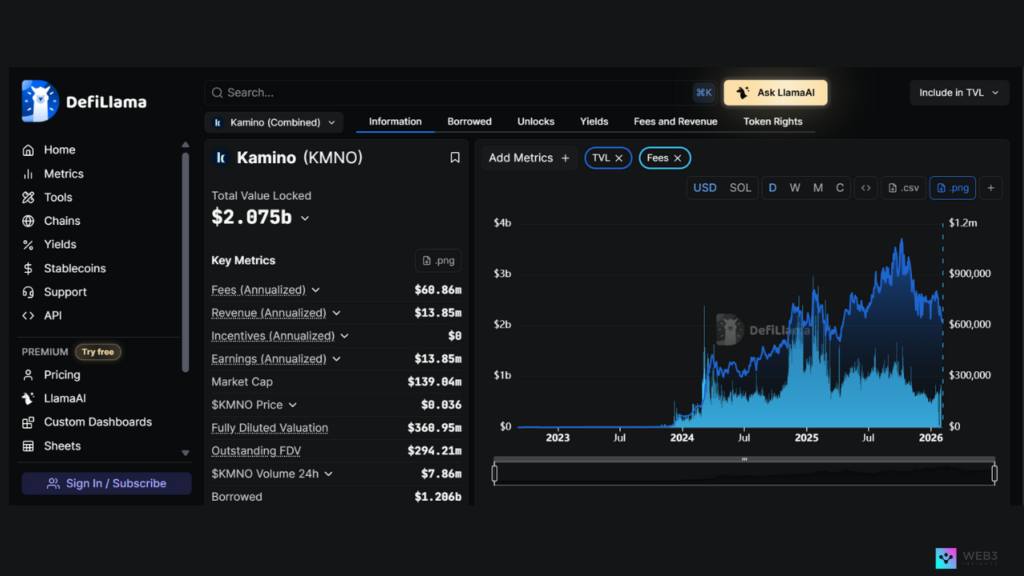

2. Kamino

Kamino has grown into one of the most capital-dense protocols on Solana, holding approximately $2.07 billion in TVL. Its strength lies in structured liquidity, automated strategies, and lending primitives that optimize idle capital.

Rather than focusing on speculative yield, Kamino attracts long-term liquidity by offering predictable returns and deep integration with Solana’s core DeFi stack. Even during periods of short-term volatility, Kamino’s TVL remains relatively resilient, reflecting strong protocol trust.

Why It Will Dominate:

Kamino’s importance in 2026 is tied to how DeFi is evolving on Solana: users are increasingly prioritizing risk-managed yield and capital optimization over high-risk farming. This positions Kamino as a foundational protocol rather than a cyclical one. As Solana DeFi matures, Kamino is poised to remain a dominant force in the Solana DeFi space.

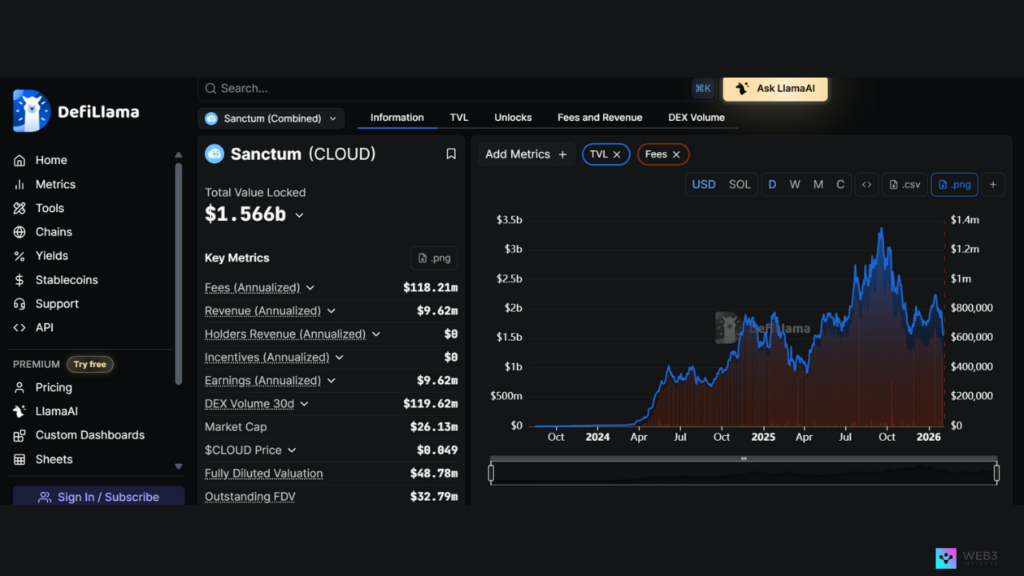

3. Sanctum

Sanctum has emerged as one of the most influential liquid staking protocols on Solana, with approximately $1.56 billion in TVL. Its growth reflects a broader trend: users want staking exposure without sacrificing liquidity.

By enabling staked SOL to remain usable across DeFi, Sanctum unlocks composability across lending, trading, and yield protocols. This creates a multiplier effect, where staked assets continue circulating rather than sitting idle.

Why It Will Dominate:

Despite short-term TVL fluctuations, Sanctum’s long-term trajectory remains strong because liquid staking is now a core pillar of Solana’s economic design. As more SOL is staked, protocols like Sanctum naturally accumulate liquidity.

In 2026, Sanctum’s dominance is less about short-term performance and more about structural necessity within the Solana ecosystem.

The Bottom Line

Solana is entering a golden era of innovation, and these three protocols are positioned to be at the forefront. Whether it’s liquidity aggregation, AMMs, or staking, these projects are leading their respective sectors with real adoption and data-backed growth.

Each protocol serves a distinct but interconnected role in Solana’s DeFi ecosystem, making them essential components of the network’s expansion. Together, they create a strong, scalable, and efficient DeFi landscape on Solana.